A Step-by-Step Guide to Calculating an Asset’s Salvage Value

A Step-by-Step Guide to Calculating an Asset’s Salvage Value

Inflation affects the real value of money and can impact the salvage value of assets. Currency fluctuations can also impact the salvage value of internationally traded assets. Changes in exchange rates can affect the value of assets in different currencies. Inflation, for instance, can reduce the purchasing power of future salvage value.

Time Value of Money

The first step is to determine this value by determining market prices for similar assets, referencing professional appraisals, or negotiating with potential buyers. Selling expenses reduce the net selling price of the asset, which in turn affects the gain or loss on the sale and ultimately the after-tax salvage value. Salvage value is the estimated value What is bookkeeping of an asset that can be recovered at the end of its useful life. It is used in depreciation calculations to determine the asset’s depreciable base. Salvage value affects depreciation, a non-cash expense that influences net income on the income statement. A higher salvage value results in lower annual depreciation expenses, potentially inflating net income.

A Step-by-Step Guide to Calculating an Asset’s Salvage Value

- It can be calculated if we can determine the depreciation rate and the useful life.

- On the other hand, underestimating salvage value could result in higher expenses than necessary.

- It is important to set an initial salvage value, which represents the estimated value of the asset at the end of its useful life.

- This guide aims to demystify the concept of after-tax salvage value, illustrating its importance in financial decision-making and providing a step-by-step process to calculate it accurately.

- Calculate the tax on the gain or loss by multiplying it by the company’s tax rate.5.

- Salvage value is considered when determining the total depreciable cost, ensuring businesses don’t overestimate depreciation expenses.

Equipment manufacturers do something similar but focus more on how their machines are used and maintained. Residual value is the estimated worth of an asset at the end of its useful life or lease term. Let us understand the advantages of terminal cash flow equations through the points below. By the end of 2022, the company’s net fixed assets were $15 million, reflecting an increase of $5 million from the Budgeting for Nonprofits end of 2021. Suppose a company started the current year (2022) with a net fixed asset balance of $10 million, which is the beginning balance ending balance in the prior period (2021).

Common approaches to estimate salvage value

- Assets subjected to high loads may have reduced salvage values, as the increased stress can lead to premature wear and tear.

- This method assumes that the asset’s value decreases at a constant rate over time.

- This means that the condition and age of the asset can greatly impact its salvage value.

- Proper asset planning also plays a key role in demand planning, helping businesses anticipate future needs and optimize resource allocation.

- In situations where IRR and NPV give conflicting decisions, NPV decision should be preferred.

- NPV analysis is commonly coupled with sensitivity analysis and scenario analysis to see how the conclusion changes when there is a change in inputs.

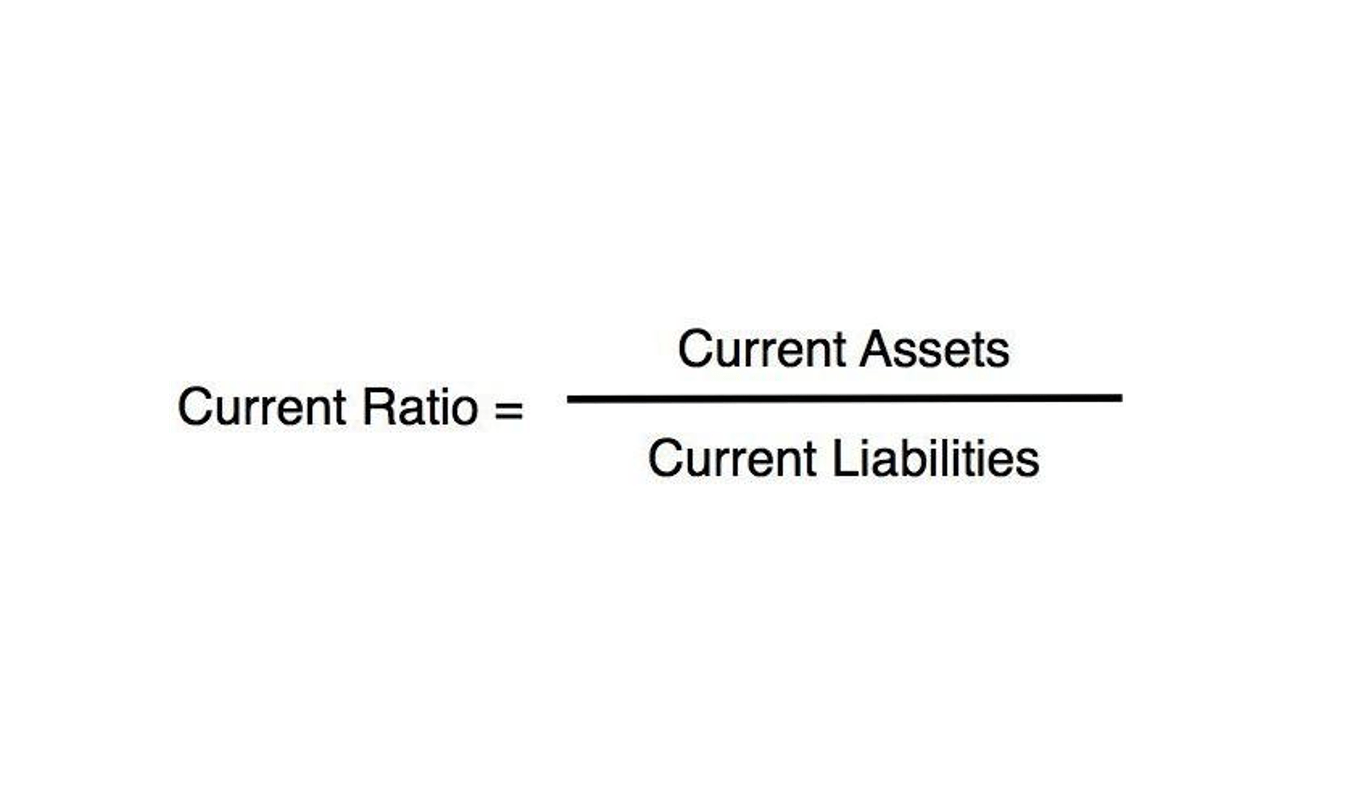

The total depreciation of an asset is calculated by subtracting its salvage value from its original purchase price. A higher salvage value means less depreciation expense each year, while a lower or zero salvage value means the asset depreciates more. Different depreciation methods treat salvage value differently, which affects financial reporting. Depending on how the asset’s salvage value is changing, you may want to switch depreciation accounting methods and report it to the IRS. Salvage value is the monetary value obtained for a fixed or long-term asset at the end of its useful life, minus depreciation. This valuation is determined by many factors, including the asset’s age, condition, rarity, obsolescence, wear and tear, and market demand.

The salvage amount or value holds an important place while calculating depreciation and can affect the total depreciable amount used salvage value by the company in its depreciation schedule. Salvage value is also known as scrap value or residual value and is used when determining the annual depreciation expense of an asset. Many businesses use industry standards and historical data to determine salvage value. Looking at past sales of similar assets helps estimate what a piece of equipment, vehicle, or building will be worth at the end of its life.

- Figuring out the online realizable worth of an asset at disposal after contemplating tax implications is a vital side of monetary planning.

- The original purchase price and any capital improvements to the asset determine the cost basis, affecting the gain calculation.

- When calculating depreciation in your balance sheet, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life.

- The salvage value calculator evaluates the salvage value of an asset on the basis of the depreciation rate and the number of years.

- It is sensitive to changes in estimates for future cash flows, salvage value and the cost of capital.

- Both declining balance and DDB require a company to set an initial salvage value to determine the depreciable amount.

- Other methods of depreciation are used to more accurately reflect the depreciation and current value of an asset.

This method involves obtaining an independent report of the asset’s value at the end of its useful life. This may also be done by using industry-specific data to estimate the asset’s value. It just needs to prospectively change the estimated amount to book to depreciate each month. Despite the various advantages, there are a few factors that prove to be a hassle. Let us understand the disadvantages of terminal cash flow calculation through the points below.

This information is typically available on the product’s packaging, website, or by speaking to a brand representative. Calculating salvage value after tax may vary depending on the type of asset, its depreciation schedule, and any applicable tax regulations. Businesses use this concept in various industries, from transportation to manufacturing and real estate. Net present value is even better than some other discounted cash flow techniques such as IRR. In situations where IRR and NPV give conflicting decisions, NPV decision should be preferred. Below is a break down of subject weightings in the FMVA® financial analyst program.